who pays sales tax when selling a car privately in illinois

Both you and the buyer will need to complete the title assignment section. The amount that you have to pay for your illinois used car sales tax or your illinois new car sales tax depends on what city you.

How To Gift A Car A Step By Step Guide To Making This Big Purchase

When you sell your car you must declare the actual selling purchase price.

. To calculate how much sales tax youll owe simply multiple the vehicles price by 006625. JMFE is an industry leader with 2008 sales of 101 billion and employing approximately 4000 associates nationwide. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

It starts at 390 for a one-year old vehicle. If you sell a vehicle to a customer who will title it in one of those states then you must charge the customer Illinois sales tax at the foreign states tax. If a vehicle is purchased privately the sales tax must be paid at a branch when you apply for the Indiana certificate of title.

If you have problems with a title or registration on Selling a vehicle in illinois. Use the illinois tax rate finder to find your tax. Cost of Buying a Car in Illinois Increased in 2020.

In cities like Detroit Lansing and Kalamazoo Michigans Craigslist can prove to be a viable option for selling your car. How Much Sales Tax On A Car In Illinois Car Sale and Rentals. If NY State sales tax was paid to a NY State dealer the DMV does not collect sales tax when you apply for a vehicle registration and the.

Selling a vehicle in illinois. For vehicles worth less than 15000 the tax is based on the age of the vehicle. When an illinois resident purchases a vehicle from an out of state dealer and will title the car in illinois the sale and subsequent tax due is reported on form rut 25 when you bring the vehicle into illinois.

Who Pays Sales Tax When Selling A Car Privately In Ny. In a nutshell the Internal Revenue Service IRS views all personal vehicles as capital assets. The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the vehicle.

To transfer your license plates after you sell your car in Illinois you will need to submit an Application for Vehicle Transaction s Form VSD 190 to the IL SOS in person. Income Tax Liability When Selling Your Used Car. Cost of buying a car in illinois increased in 2020 So if.

There is also between a 025 and 075 when it comes to county. However there WILL be an audit by the Illinois Department of Revenue that shows the fair market value is 60000. This tax is paid directly to the Illinois Department of Revenue.

Who pays sales tax when selling a car privately in illinois Monday March 14. If you sell a 2017 Mercedes and claim a sale price of 15000 or less you will have to pay tax on the 15000 or less val-uation. See RUT-6 Form RUT-50 Reference Guide to determine whether you must report any local government private party vehicle use tax on Form RUT-50.

Who pays sales tax when selling a car privately in illinois. Do you pay taxes when you sell a car in illinois Thursday April 21. Vehicle sales tax for vehicles sold by a dealer Usually 625 but can vary by location Use the Illinois Tax Rate Finder to find your tax Vehicle use tax for vehicles purchased from another individual or private party Usually 625 but can vary by location Use the Illinois Tax Rate Finder to find your tax.

It ends with 25 for vehicles at least 11 years old. Do not let a buyer tell you that you are supposed to. However you do not pay that tax to the car dealer or individual selling the car.

If you sell it for less than the original purchase price its considered a capital loss. Who pays sales tax when selling a car privately in illinois. Exemptions If one of the following exemptions applies.

If you sell a vehicle to a customer who will title it in one of those states then you must charge the customer Illinois sales tax at the foreign states tax rate or at 625 whichever is less. In addition to completing the application form you. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

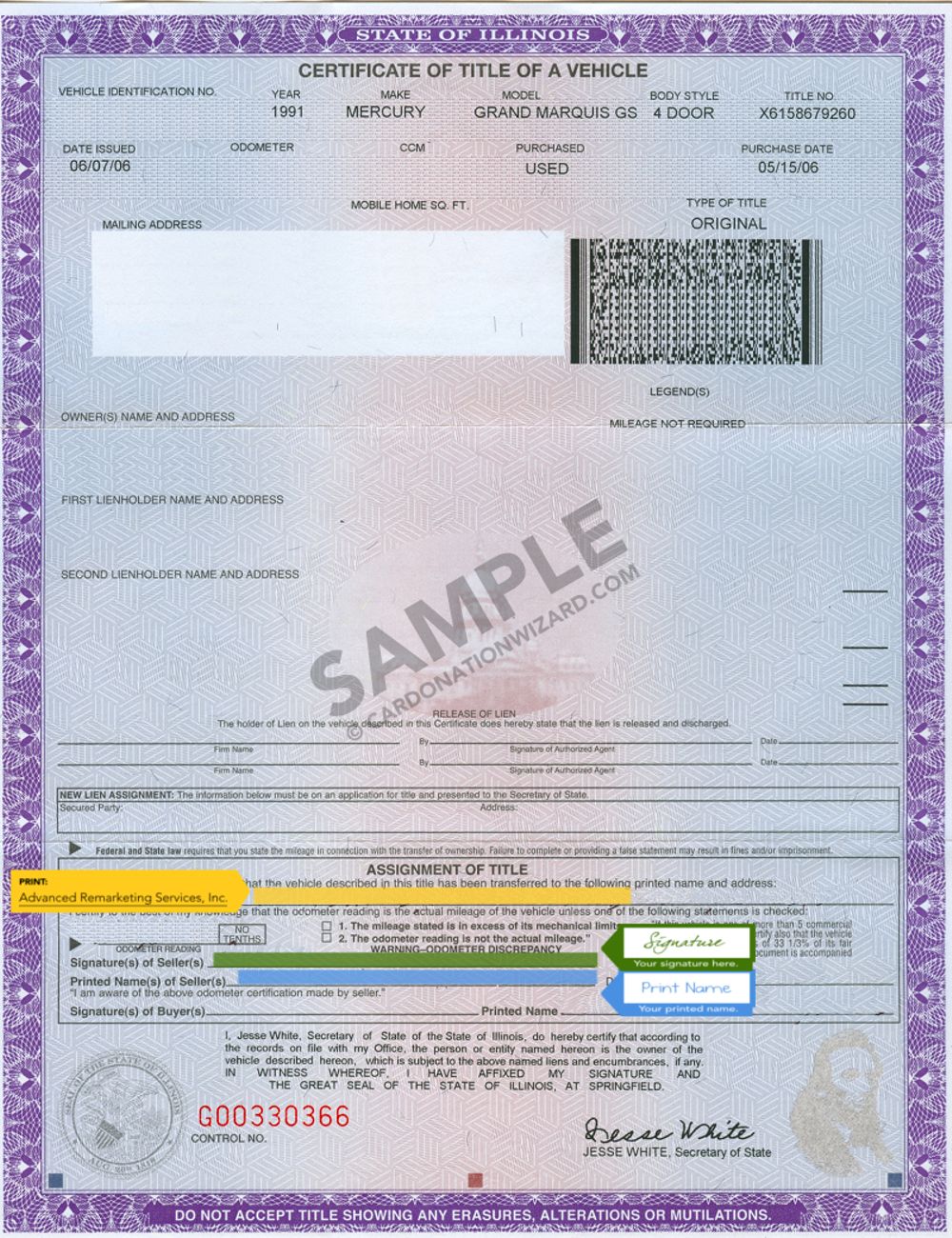

Enter the part of the sellers property including the mileage date of sale and sale price of the vehicle. Registration When you buy a car from a dealer or private seller you will need to register the license plate. However if you sell it for a profit higher than the original purchase price or what is.

The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. In Michigan sales tax applies. Illinois Private Party Vehicle Use Tax Step 6 Line 1 Other transaction types that may be reported on Form RUT-50 are listed below along with the required tax amount due.

A list of all the states for which you must collect sales tax and the rate you must charge can be found on the Illinois Department of Revenues website. When you register a car or transfer registration stamp duty is payable. Number 2220116 Illinois private party vehicle use tax is based on the purchase price or fair market value of the.

The buyer will have to pay the sales tax when they get the car registered under their name. However the scenario is different when you profit from the sale. You may even find that a local Michigan sales group on Facebook is pretty good.

You can also pick up a form at the Illinois SOS office or request one to be sent to you by calling 800 252-8980. Buyers must pay a transfer tax when they buy a car from a private seller in Illinois although this tax is lower when you buy from a private party than when you buy from a Dealer. Sign the bill of sale even if it is a gift pay sales tax or have proof of an exemption.

You will pay it to your states DMV when you register the vehicle. New opportunities are waiting for you. If a vehicle is purchased from an Indiana dealership the dealer will collect the sales tax and provide proof of the sales tax paid on an ST108 Certificate of Gross Retail or Use Tax Paid State Form 48842.

Sales taxes in Illinois are calculated before rebates are applied so the buyer who pays 9500 after a 2500 rebate will still pay sales tax on the full 12000. This means you do not have to report it on your tax return. There is also between a 025 and 075 when it comes to county tax.

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

What Is The Sales Tax On A Car In Illinois Pasquesi Sheppard Llc

Steps To Take When Selling A Car In Illinois Cash Cars Buyer

What Is Illinois Car Sales Tax

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

Nj Car Sales Tax Everything You Need To Know

How Do I Sell My Car Illinois Legal Aid Online

Steps To Take When Selling A Car In Illinois Cash Cars Buyer

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

Who Pays Taxes On A Gifted Vehicle Sell My Car In Chicago

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Illinois Used Car Taxes And Fees

Which U S States Charge Property Taxes For Cars Mansion Global

Steps To Take When Selling A Car In Illinois Cash Cars Buyer

How To Buy A Car Out Of State Nextadvisor With Time

Steps To Take When Selling A Car In Illinois Cash Cars Buyer

Illinois Car Trade In Tax Changes Starting January 2020 Honda City Chicago